Just how to Take full advantage of the Benefits of a Secured Credit Card Singapore for Financial Development

Just how to Take full advantage of the Benefits of a Secured Credit Card Singapore for Financial Development

Blog Article

Unveiling the Possibility: Can People Discharged From Insolvency Acquire Credit Report Cards?

Comprehending the Effect of Personal Bankruptcy

Upon declare insolvency, people are confronted with the considerable effects that penetrate various facets of their economic lives. Personal bankruptcy can have a profound effect on one's credit history, making it challenging to access credit or loans in the future. This monetary stain can linger on credit scores reports for several years, influencing the person's capacity to protect positive rate of interest or economic possibilities. In addition, personal bankruptcy might result in the loss of possessions, as specific belongings might need to be sold off to repay financial institutions. The psychological toll of insolvency ought to not be undervalued, as individuals might experience feelings of anxiety, pity, and guilt as a result of their financial scenario.

Furthermore, insolvency can restrict work chances, as some companies perform credit score checks as component of the hiring procedure. This can posture an obstacle to people seeking new job prospects or career improvements. On the whole, the influence of bankruptcy extends beyond financial restrictions, affecting different aspects of a person's life.

Factors Impacting Charge Card Authorization

Getting a bank card post-bankruptcy is contingent upon different vital factors that significantly influence the authorization procedure. One crucial element is the applicant's credit history. Complying with insolvency, people usually have a reduced credit history rating because of the unfavorable influence of the insolvency filing. Charge card companies typically look for a debt rating that demonstrates the candidate's capability to manage credit rating responsibly. An additional necessary factor to consider is the candidate's revenue. A secure earnings assures credit score card companies of the person's ability to make timely settlements. In addition, the length of time considering that the personal bankruptcy discharge plays a vital role. The longer the period post-discharge, the a lot more positive the possibilities of approval, as it indicates financial security and responsible credit rating habits post-bankruptcy. Additionally, the sort of credit score card being looked for and the company's details requirements can likewise influence approval. By very carefully thinking about these variables and taking actions to reconstruct credit report post-bankruptcy, individuals can boost their potential customers of acquiring a charge card and functioning in the direction of economic recovery.

Steps to Rebuild Debt After Personal Bankruptcy

Rebuilding debt after bankruptcy requires a tactical method focused on monetary technique and consistent debt management. One effective technique is to get a guaranteed debt card, where you deposit a specific amount check as security to develop a credit rating limit. Additionally, think about coming to be an accredited user on a household member's credit score card or discovering credit-builder financings to more improve your debt rating.

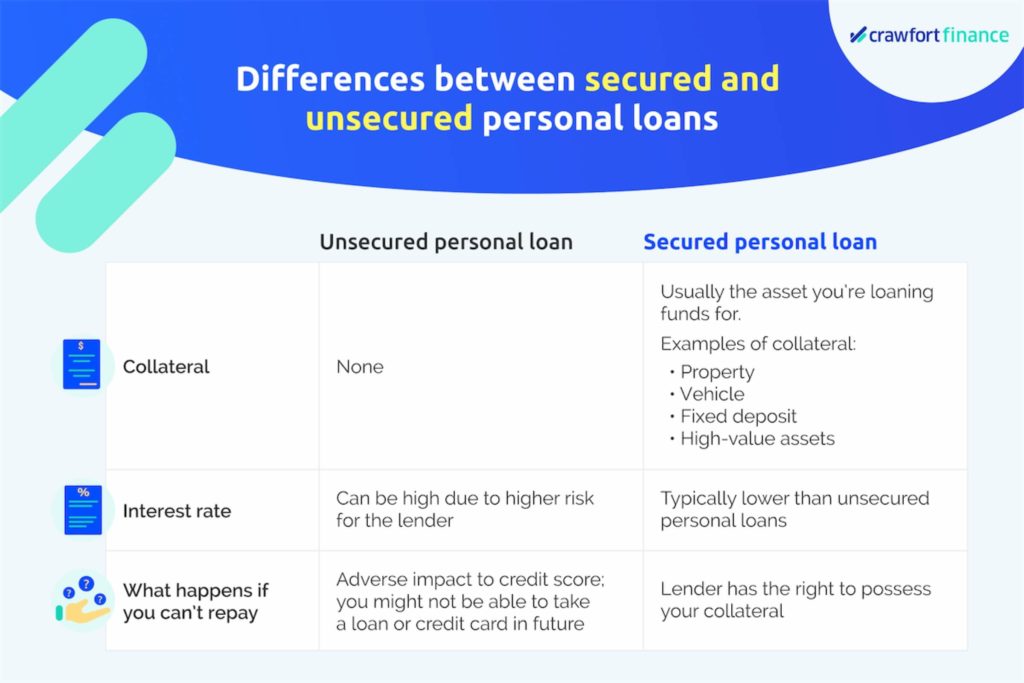

Safe Vs. Unsecured Debt Cards

Complying with bankruptcy, people typically think about the choice in between protected and unprotected credit report cards as they aim to restore their credit reliability and Check This Out financial security. Safe debt cards call for a cash down payment that serves as collateral, typically equivalent to the credit history limit provided. Eventually, the choice in between safeguarded and unprotected credit score cards should straighten with the individual's financial goals and capability to handle credit history responsibly.

Resources for Individuals Seeking Credit History Rebuilding

One useful source for people looking for credit scores rebuilding is credit counseling firms. By functioning with a credit rating therapist, people can obtain insights into their debt records, learn approaches to boost their credit history scores, and receive assistance on managing their financial resources properly.

One more useful resource is credit history monitoring solutions. These solutions enable individuals to maintain a close eye on their credit score records, track any type of mistakes or adjustments, and find potential indications of identification theft. By checking their credit scores routinely, individuals can proactively address any kind of issues that may guarantee and arise that their credit score information depends on date and accurate.

Furthermore, online tools and resources such as credit history simulators, budgeting applications, and economic literacy web sites can provide people with valuable info and tools to aid them in their debt reconstructing journey. secured credit card singapore. By leveraging these resources effectively, people discharged from bankruptcy can take purposeful actions in the direction of enhancing their credit history wellness and protecting a far better economic future

Conclusion

To conclude, people released from insolvency may have my blog the possibility to obtain credit history cards by taking steps to restore their credit history. Factors such as credit report background, income, and debt-to-income ratio play a considerable role in bank card approval. By comprehending the influence of insolvency, picking in between safeguarded and unsafe charge card, and making use of resources for credit scores rebuilding, people can improve their credit reliability and possibly obtain accessibility to credit cards.

By functioning with a credit counselor, people can gain understandings right into their credit history reports, discover strategies to enhance their credit report scores, and receive assistance on handling their funds properly. - secured credit card singapore

Report this page